As I pen this piece in the middle of February, 2024, the outlines of the 2025 American ski market are coming into ever sharper focus. Every important brand has not only pitched its next collection to its retail partners, most initial orders have already been written, setting the stage for what should be a very consumer-friendly spring as far as ski sales are concerned.

There are two key components that drive this looming shopping bonanza: the first, and most important, element is a slow-sales year that has a lot of the skis ordered preseason last year still on the shelves. Waiting in the wings is the second driver, orders for new models that will obsolete the current generation as soon as they show up. The classic solution to this conundrum is to sweeten the deal on the leftovers to make room for the newcomers, lowering the price on models that were considered state-of-the-art just a few weeks ago.

As I mentioned in Twilight of the Idols last month, some of the most coveted models of the last decade have reached the end of their product life-cycle. If you’ve ever wanted a Bonafide, Enforcer or Mantra – or a Black Pearl, Santa Ana or Secret 96 – you’ll never have a better chance to get it in the size you want than right now. In addition to this sextet of perennial sales leaders, generational model turnover is also impending at Atomic, Dynastar, Fischer, Head, Rossignol, Kästle and Liberty.

After a season in which only a handful of second-tier model families were re-vitalized with some sort of upgrade, the 2025 season is chock full of new models that I’m pleased to report are palpably superior to the generation they replace. While I’ve yet to ski every new model of note, most of what I’ve essayed so far have been very impressive. It’s reassuring to see so many brands investing in new designs that deliver high performance that reward good skiing without extracting a high toll in the effort department. With each passing birthday, I grow more appreciative of designs that exemplify this energy-conservation consciousness.

There are a couple of reasons why I find this year’s bumper crop of new skis so encouraging. In a seasonal market dependent on increasingly fickle weather, smart money might be tempted to slow down new product introductions to a bare minimum. That instead we see considerable market pressure to keep the innovation hammer down while keeping the incremental cost to consumers hovering around zero. (Most new models did not increase their MSRP for next year.)

Any time a new construction infiltrates a corner of a product line, it sets up the next few seasons for additional new models to roll out as the latest tech spreads across the collection. This is the second aspect of the 2025 U.S. market that gives me hope for the future: the seeds of change have now been planted across multiple product lines that will extend 2025’s new ideas well into the future. Timetables are already in place that will ensure a regular flow of model turnover, barring catastrophic intervention such as a second pandemic or a snowless season across the globe.

Calling All Ski Testers!

If you’re addicted to skiing – and, mercifully, many of you are – you get a special frisson of excitement whenever you step into a new pair of skis. After forty years of ski testing, I can attest that the thrill of trying out a freshly prepped pair of one of the best skis money can buy does not diminish over time. Gauging its receptivity to edging action, its capacity to shift into a drift on a whim, it’s inherent speed limit and a host of other attributes, is both a thrill and a skill. In the course of one or two runs – ideally in a variety of conditions – an experienced tester should be able to limn the limits of the model under review.

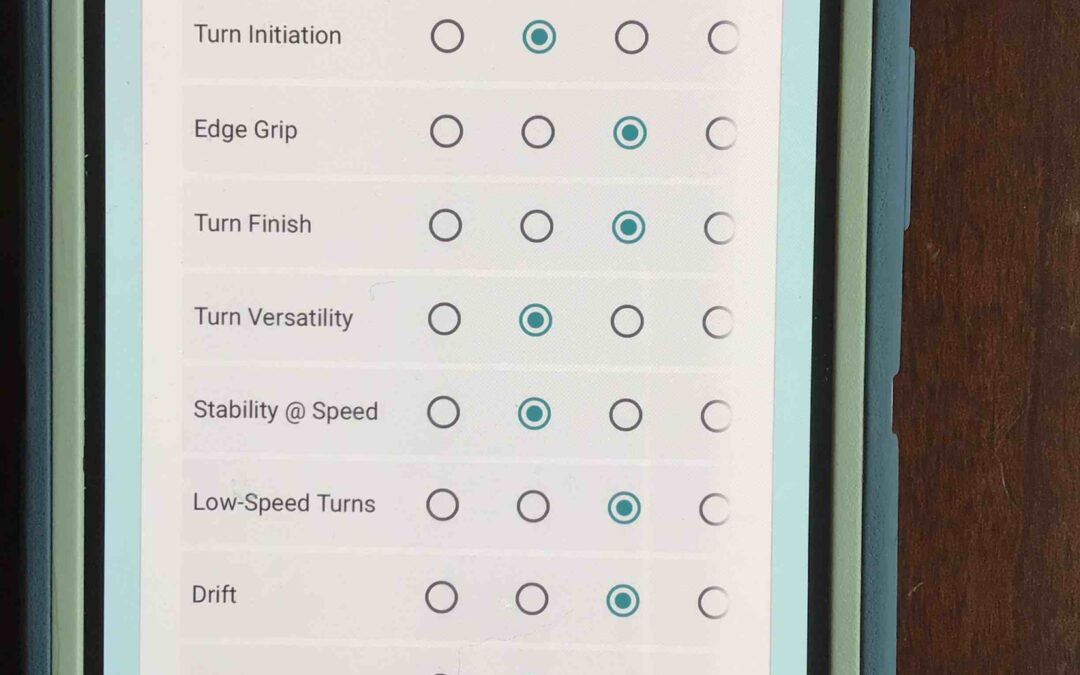

It is both to facilitate and to provide a record of this bundle of experiences that I’ve revised my test card into a new digital format that uses Google docs as its medium. Please note you don’t have to have a Google email address or any other Google functions, but if you do use Google Chrome or have a Google address, you’ll be able to edit your entries, should you so desire.

Veteran testers will note that I’ve modified the 10 test criteria just a tad to improve comprehension and to help compress the “card” to a space only slightly larger than the usual cell phone screen, limiting scrolling to a bare minimum. To make the chore of data entry go faster, testers enter their email address and shop affiliation only once, rather than re-entering this info for every submission. (If you’re a citizen tester without a shop affiliation, just enter the letter “C” as your associated shop.)

To help cast the widest net we can, in addition to the link below, we’ve posted a link to the new test card on the Realskiers.com home page, right below the Testimonials. (If you happen to be a shop tester who has used a digital test card accessed via a QR code, please do NOT use the old, 6-criteria card to which it connects.) If you are specialty retailer, you don’t have to be an official Realskiers Test Center to contribute; you just have to be willing to play. I look forward to seeing your data and comments!

Related Articles

The Making of a Skier, Chapter XI: Desperate Measures

When Head humanely, if rather brusquely, terminated my tenure in 2001, the ski business in the U.S. was already facing stiff headwinds, a brewing storm that would turn into a full-on debacle when 9/11 disrupted all commerce. I became unemployed just in time for the job market to implode.

I don’t handle inactivity well. I started writing a very long, very dreadful novel, composed a handful of scripts for Warren Miller – and later, Jeremy Bloom – to recite and scribbled batches of brochure copy and white papers for industries as diverse as accounting software, instrumented football helmets that registered concussions and risk assessment based on location.

The pickings were slim, but they wouldn’t have amounted to anything at all were it not for a little help from my friends. Andy Bigford, who I’d worked with at Snow Country, hired me for the Warren Miller gig. A college chum kindly engaged me to write white papers on accounting fraud. But it was Dave Bertoni, an erstwhile colleague from Salomon days, who joined me in creating Desperate Measures: A Training Method for Selling Technical Products at Retail.

Reader Comments on Why Ski Sales Have Shrunk

In this week’s Revelation, I posted my top ten (twelve, actually) reasons why skis sales have shrunk, along with the musings of two Dear Readers on the subject. Note that the topic’s focus was ski sales at retail, not skier or skier/rider participation rates, subjects that are certainly related but just as certainly not the same.

Below are verbatim reader responses culled in the last 48 hours. I’ve corrected the odd typo, but otherwise left these contributions intact.

My thanks to all who took the time to tell their tales. – J

Top Reasons U.S. Ski Sales Have Shrunk

[As I wrapped up an earlier Revelation, I proposed to my beloved readership that they share their list of the top ten reasons U.S. ski sales have shrunk. I elicited only two written responses, so I’ll reproduce both here in their entirety, along with my musings on the subject. Consider these submissions tinder to light a fire under you, Dear Reader, to submit a list of your own.]

From Rick Pasturczak

1. Snowboarding-

I’ve noticed most snowboarders are 12 to 20 years old and once they become an adult, almost all stop. While I noticed most skiers continue on.

2. High school and college sports-

Schools now require practicing sports during Christmas and spring breaks taking away opportunities to hit the slopes and family vacations to the mountains. I’ve been told by many parents the coaches forbid them to ski.

3. Travel costs-

Lodging, airfare, ground transportation, and lift tickets.

4. Video games

5. Cost of lessons make it expensive to improve.

6. Confusing selection of equipment

7. Magazines and movies showing extreme skiing

8. Cruising. We need some resorts to be all inclusive.

9. Baggy pants. Bring back stretch pants and sex appeal.

10. Last, we need mother nature to be more consistent with snow.