As I pen this piece in the middle of February, 2024, the outlines of the 2025 American ski market are coming into ever sharper focus. Every important brand has not only pitched its next collection to its retail partners, most initial orders have already been written, setting the stage for what should be a very consumer-friendly spring as far as ski sales are concerned.

There are two key components that drive this looming shopping bonanza: the first, and most important, element is a slow-sales year that has a lot of the skis ordered preseason last year still on the shelves. Waiting in the wings is the second driver, orders for new models that will obsolete the current generation as soon as they show up. The classic solution to this conundrum is to sweeten the deal on the leftovers to make room for the newcomers, lowering the price on models that were considered state-of-the-art just a few weeks ago.

As I mentioned in Twilight of the Idols last month, some of the most coveted models of the last decade have reached the end of their product life-cycle. If you’ve ever wanted a Bonafide, Enforcer or Mantra – or a Black Pearl, Santa Ana or Secret 96 – you’ll never have a better chance to get it in the size you want than right now. In addition to this sextet of perennial sales leaders, generational model turnover is also impending at Atomic, Dynastar, Fischer, Head, Rossignol, Kästle and Liberty.

After a season in which only a handful of second-tier model families were re-vitalized with some sort of upgrade, the 2025 season is chock full of new models that I’m pleased to report are palpably superior to the generation they replace. While I’ve yet to ski every new model of note, most of what I’ve essayed so far have been very impressive. It’s reassuring to see so many brands investing in new designs that deliver high performance that reward good skiing without extracting a high toll in the effort department. With each passing birthday, I grow more appreciative of designs that exemplify this energy-conservation consciousness.

There are a couple of reasons why I find this year’s bumper crop of new skis so encouraging. In a seasonal market dependent on increasingly fickle weather, smart money might be tempted to slow down new product introductions to a bare minimum. That instead we see considerable market pressure to keep the innovation hammer down while keeping the incremental cost to consumers hovering around zero. (Most new models did not increase their MSRP for next year.)

Any time a new construction infiltrates a corner of a product line, it sets up the next few seasons for additional new models to roll out as the latest tech spreads across the collection. This is the second aspect of the 2025 U.S. market that gives me hope for the future: the seeds of change have now been planted across multiple product lines that will extend 2025’s new ideas well into the future. Timetables are already in place that will ensure a regular flow of model turnover, barring catastrophic intervention such as a second pandemic or a snowless season across the globe.

Calling All Ski Testers!

If you’re addicted to skiing – and, mercifully, many of you are – you get a special frisson of excitement whenever you step into a new pair of skis. After forty years of ski testing, I can attest that the thrill of trying out a freshly prepped pair of one of the best skis money can buy does not diminish over time. Gauging its receptivity to edging action, its capacity to shift into a drift on a whim, it’s inherent speed limit and a host of other attributes, is both a thrill and a skill. In the course of one or two runs – ideally in a variety of conditions – an experienced tester should be able to limn the limits of the model under review.

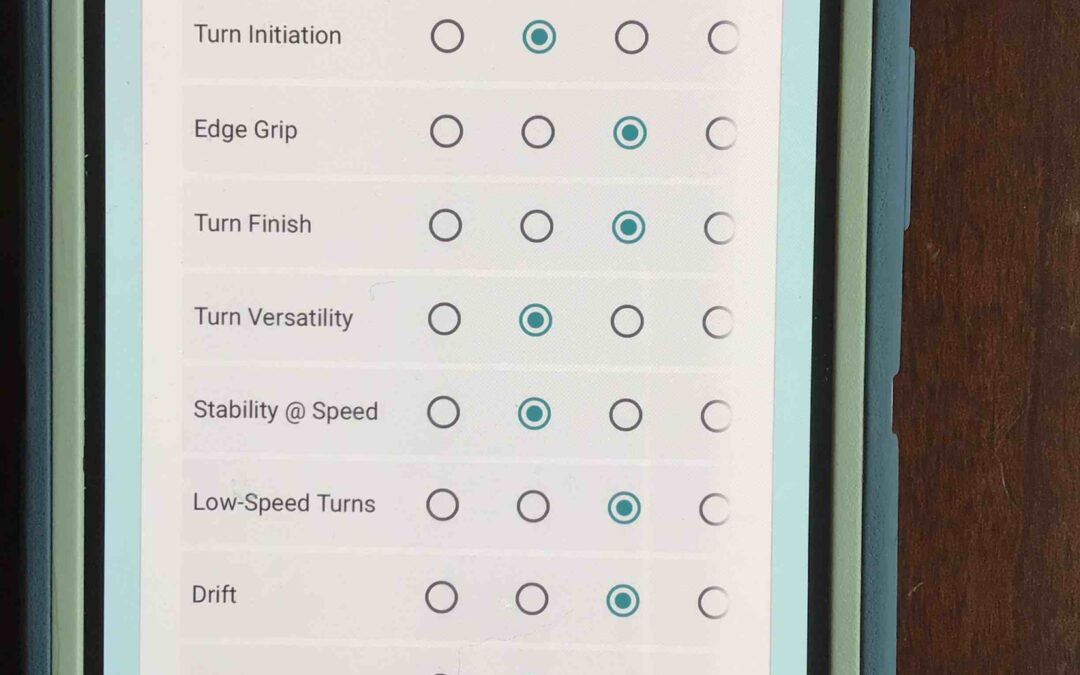

It is both to facilitate and to provide a record of this bundle of experiences that I’ve revised my test card into a new digital format that uses Google docs as its medium. Please note you don’t have to have a Google email address or any other Google functions, but if you do use Google Chrome or have a Google address, you’ll be able to edit your entries, should you so desire.

Veteran testers will note that I’ve modified the 10 test criteria just a tad to improve comprehension and to help compress the “card” to a space only slightly larger than the usual cell phone screen, limiting scrolling to a bare minimum. To make the chore of data entry go faster, testers enter their email address and shop affiliation only once, rather than re-entering this info for every submission. (If you’re a citizen tester without a shop affiliation, just enter the letter “C” as your associated shop.)

To help cast the widest net we can, in addition to the link below, we’ve posted a link to the new test card on the Realskiers.com home page, right below the Testimonials. (If you happen to be a shop tester who has used a digital test card accessed via a QR code, please do NOT use the old, 6-criteria card to which it connects.) If you are specialty retailer, you don’t have to be an official Realskiers Test Center to contribute; you just have to be willing to play. I look forward to seeing your data and comments!

Related Articles

Just How Strange Will the 21/22 Ski Market Be?

To (temporarily) kowtow to the cult of brevity, the short answer is, “not very.”

To elaborate, most major ski brands didn’t derail the introduction of new products that were in the works well before the pandemic dropped the hammer. There’s a rhythm to the product renewal cycle that shifts the spotlight every year to a different model family within any brand’s global collection; that rhythm was largely respected despite the unique obstacles imposed on the process this year. If most of the models appearing in 21/22 catalogs seem similar to what was offered this year, it’s because this is how the line renewal machinery ordinarily operates.

What’s difficult to judge from outside the R&D pipeline is what we’re not seeing. That is, were there more new models or upgrades to existing star products ready to launch that were put on hold to avoid overloading a potentially weakened distribution network? Possibly; what might have been a planned six-model launch may have been trimmed to three or four, for example.

Happily, there’s no real downside to this scenario for the prospective ski buyer. All essential model family refreshing and line extensions will unfold as forecast. If you haven’t bought a ski in three or four years – I believe the average span between new ski purchases is over seven – the entire universe of Alpine skis is new to you. You may spot some names you recognize, but the skis that bear the name will almost assuredly be different.

“How Is It in The Bumps?”

This question is one of the last objections a ski buyer tosses into the flow of the sale just as the salesperson has guided it to the brink of consummation. To keep the impending close on course, the suave salesperson will hedge the issue with some bland reassurance without raising the obvious retort, that no ski can overcome all the many and curious ills that plague the untalented mogul skier.

A great skier can manage bumps no matter what ski he or she is on. That doesn’t mean experts don’t have favorite skis for this spine-rattling condition, but they don’t need to change skis just because they encounter a bump field. They’ll manage, and chances are anyone watching them won’t be able to tell if the ski is helping, hurting or just along for the ride.

To get the subject out of the way, there are such things as mogul skis, but they’re made for competitors, not your everyday, all-terrain skier. Their tiny (61mm-66mm) waists and svelte sidecuts were common 25 years ago, but they’re as rare as bacon at a bar mitzvah today. Unless you’re planning to compete, there’s no reason for you to fish in this pond.

The Savvy Shopper: How to Buy Skis

Let’s begin with a recap of the fundamentals.

Realskiers’ model selection methodology starts by dividing the Alpine ski market into seven categories, using waist width as the organizing principle for three excellent reasons:

1. This dimension is the single best indicator of the ski’s capabilities.

2. Waist width is a hard number, not a fuzzy concept like skier type.

3. Suppliers product lines align with this method, creating models in every category according a coherent pricing logic.