This isn’t the typical season-opening salvo from Realskiers.com that my Dear Readers and Dear Listeners have come to expect. In years past, I’ve kept the focus on emerging trends as exemplified by interesting new models and where they fit in the big picture. The intent has always been to celebrate excellence, acknowledge competence and remain silent about the also-rans. In the small world of alpine skiing, I didn’t want to become known as one of the “nattering nabobs of negativity,” as the immortal Spiro Agnew once characterized the press.

But the sands beneath the ski trade’s foundations have shifted to the point that the supplier community’s business practices are inextricably entwined with its interest in – and capacity for – meaningful new product development. Shifting tides in brand ownership have resulted in the dismantling of entire management teams, not because they were unsuccessful, but because they were quite the opposite, and therefore cost too much to retain.

I’m compelled to highlight the rot below the ski trade’s sunny surface because many skiers harbor deep brand loyalties that are, to put it mildly, no longer merited. In my lifetime, perhaps no brand has spoken more directly to, and connected more deeply with, the American skiing public than K2. If you are a K2 fan, you should know that the people behind the brand you feel such warm fuzzies for are long gone. The husk of a brand the robber barons have left in their wake has so alienated a once fiercely loyal dealer base, that the survival of K2 as presently constituted is very much in doubt.

The seeds of the current crisis were sown several ownerships ago, when K2 was part of a bundle of ski properties assembled by Jarden, a diverse consumer products conglomerate that was sold to Newell Brands for $16 billion in 2016. At the time, the incoming CEO sought to reassure doubtful investors that if the handful of ski brands it had acquired didn’t find a buyer, he would simply liquidate them rather than see them dilute the bottom line.

This declaration made it abundantly clear that the entire ski trade has never been more than a rounding error for this tribe of money managers.

K2’s current owner, Kohlberg and Company, has been trying to off-load its entire ski-related portfolio (K2, Völkl, Line, Dalbello, Marker and BCA) by bundling them all into a separate, stand-alone entity, Elevate Outdoors. A deal for Elevate Outdoors was almost consummated about three years ago, but when it came unglued, K2’s overseers began to strip it down to the bare essentials, shedding any expense that diminished its potential gross margin. At the same time that it dropped out of the Winter Sports Retailers association, the brand amped up its direct-to-consumer sales initiative, reminding ski retailers several times a week – via its carpet-bombing Internet campaign – that they would be fools to compete with direct-from-the-factory sales.

If K2’s only offense was selling against its own dealers, it would simply be engaging in what has become accepted practice. (More on this topic in a minute.) But K2’s thumb-in-the-eye approach to dealer relations doesn’t end with its direct-to-consumer initiative; it even created a special ski line that it sold only on-line and at very elevated pricing. For example, a special-edition Disruption T12 USA carried an MSRP of $1,749 – I kid you not – with a discounted price of $1,224.30 (love the 30 cents). This from a brand that hadn’t made a race ski in well over a decade, which at other brands would have at least demonstrated some established proficiency at making a first-rate carving machine. The Disruption T12 USA instead demonstrated just how far the brand had strayed from its roots. (Parenthetically, it also demonstrated that K2 could make a good ski if it tried hard enough, but perhaps not in China.) Most crucially, this silly adventure into a price range K2 will never inhabit showed how willing the new K2 was – and remains – to compete directly with the very dealers that built the brand in this county.

“A house divided against itself cannot stand”

Lincoln used this Bible verse (Matthew 12:25) to describe how the battle over slavery was tearing America apart, but it could also serve as a status report on the forces currently confronting the specialty retail community and the manufacturers and distributors who supply them in this country. Three years ago, at the annual meeting of the principal dealer buying associations, where suppliers unveil their products and programs for the coming season, Salomon announced that – following Nike’s lead – they would no longer share the profits of online sales with its retailers. Said retailers were not amused, but the handwriting was already on the wall; shops and their suppliers were about to enter an epoch in which both camps would openly compete for the online customer. Thomas Hobbes’ depiction of the natural world as a perpetual battle of each against all is an accurate portrayal of the U.S. ski market today.

I’m not in possession of any insider knowledge, but I would be shocked if K2’s gamble that increases in direct-to-consumer sales would off-set any losses to its wholesale business pays off. Dallas Goldsmith, co-proprietor (with sister Danielle) of Goldsmith’s Sports in Big Bear Lake, California, sums up his assessment of the current situation with K2.

“What’s sad to me is that in the corporate world we live in, we are continuing to make it more difficult for the true Mom and Pop shops to survive. I love the K2 brand, always have, but they’ve certainly changed my perspective with their move out of the Winter Sports Retailer family and their direct-to-consumer approach. But like I always do, I will look at this as a challenge from K2 rather than a slap in the face, which is what it really is.”

K2 isn’t the only major brand to have strayed from its roots over the course of the last several seasons. The only brand with even more sustained success selling skis to the American public has been Rossignol, the French powerhouse that also owns Lange, Look and Dynastar. Several years ago, Rossi went on a diversification spree that continues to divert resources away from the core ski biz that built the brand in the first place. Rossi put its name on hiking boots, casual footwear, technical outerwear, athleisure clothing, and designer women’s parkas, pants, sweaters, etc. Rossi also bought a mountain bike brand shortly before e-bikes gutted the entire category and continues to operate brand concept stores in Aspen, Paris and Courchevel.

If this sounds like Rossignol is hellbent to leverage its brand name every way it can think of (other than making skis), you’re reading the tea leaves correctly. All of these endeavors require time and money to mature into profit centers. While it’s more than likely that Rossi will be able to keep this multipronged brand expansion afloat for the foreseeable future, it doesn’t appear as though the brand has made many inroads in the categories in which they’ve so lavishly invested.

The reason Rossi’s extracurricular pursuits matter to you, Dear Reader and/or Listener, is that the fortune being spent on all these activities is money that isn’t being invested in skis. Rossi continues to invest in its Hero race skis because racing at the Olympic level is a form of brand promotion Rossi knows how to exploit. And Rossi is assuming a leading role in reducing ski manufacturing’s considerable negative environmental impacts, which is certainly to their credit.

But all this activity doesn’t change the fact that Rossi is no longer the dominant brand among advanced and expert skiers that it once was. At one time in the not-so-distant past, it seemed like the best skiers on any mountain were on Rossi’s, or perhaps Dynastars. That is not the case anymore.

Another iconic brand that is currently being buffeted by the winds of change is Völkl. As part of the Elevate Outdoors debacle, Völkl saw its offices shuttered and its entire management team – inarguably one of the best in the U.S. – either prodded off the retirement plank or dismissed outright after a 5-minute exit interview. Völkl is currently in the care of Tracy Gibbons, a well-respected ski industry veteran who formerly served at the helm of Sturtevant’s in Seattle and most recently managed the hard goods category at Christy Sports. Mercifully, the damage at Völkl has yet to spread to its R&D department, which continues to roll out exceptional new models according to a well-conceived development cycle.

So What?

Now that I’ve (nearly) finished hyperventilating over the current state of the ski trade, permit me to throw some water on my own fire. If there is a single take-away from the scenario I’ve just sketched, it is that this too, shall pass. Every brand goes through a cycle of success, turmoil and re-building; it’s just that it hurts a small industry like skiing more when big brands go astray.

Examples of brands that sank to the bottom only to rise again abound. When I orchestrated the Snow Country Magazine equipment tests in the early 1990’s, Blizzard and Kästle were clown acts that populated the bottom of every category’s results. Over the course of the last decade, Blizzard has become a dominant force and Kästle has carved out a durable, high-end niche. Salomon has been, by and large, a marketing juggernaut, but it, too, lost its edge when it slapped together the Axendo to show it (finally) was on the carving boat, and again with the surfy BBR, which sank like a stone despite a hefty marketing push. Nordica steered into the ditch with its woebegone Fire Arrow boots, only to revive its fortunes with the Speed Machine series, which began an R&D cycle culminating in the very successful full line Nordica sells today.

The main reason the overall landscape won’t change that drastically is that the retail community prizes its brand partnerships. No one wants to sever relations with an important brand that the shop has been doing business with for years. After all, retailers spend a lot of their own time and money building the brands they represent; it’s a big investment to walk away from. Perhaps most importantly, ours is a person-to-person business; shops form relationships with the reps who cater to them. There are people involved in this equation, not just things or price points.

At the end of the day, the shop is going to prefer to keep the relationship door open, so savvy specialists will stock what they feel they must to maintain a relationship. There is little doubt in any industry insider’s mind that Rossignol has the people and the industrial capacity to return to the summit it once occupied. Even present pariah K2 will surely rise again, buoyed by its strong name, favorable brand image with the consumer and longstanding retailer relationships.

Even if every skier in the world bought his or her skis online – a dystopian future I sincerely hope is not in the cards – skiers will still need someplace to go for expert bootfitting, without which it doesn’t much matter what ski you get or where you get it; you’re toast any way you slice it. Bottom line, the remaining brands need the specialty retailer to provide essential services they can’t, and the shops need strong, engaged brands that deliver on skier expectations for performance. We may currently be at the nadir of supplier/retailer relations, but even if this were true, it would also mean that better days are just one sales cycle away.

Related Articles

The Beginning of the End

Last Thursday, I skied for the first time since recovering from lumbar fusion surgery. I use the term “recovering,” as that’s the blanket term for whatever time it takes to restore the functionality...

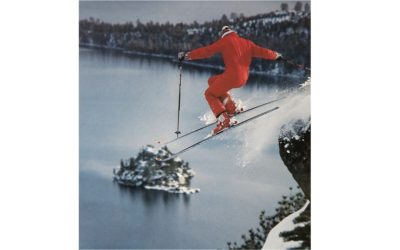

Larry Prosor belongs in the U.S. Ski & Snowboard Hall of Fame

Larry Prosor didn’t just document the birth of extreme skiing in America, he ignited it. The spark was lit by a nine-page barrage of eye-popping images lovingly displayed in the pages of Powder...

On Beyond Stöckli

Twenty-five years ago, even astute ski industry insiders wouldn’t have predicted that tiny Swiss brand Stöckli would one day be the darling of the specialty retail channel. Then as now, Stöckli’s...