Twenty-five years ago, even astute ski industry insiders wouldn’t have predicted that tiny Swiss brand Stöckli would one day be the darling of the specialty retail channel. Then as now, Stöckli’s deepest roots are in the race community, and its ski line reflects this heritage. I recall several years of testing for SKI magazine when seemingly every Stöckli was perfectly designed and tuned to win a Super G.

A toe-hold in FIS-level speed events isn’t normally a springboard to broad-based market success, and Stöckli’s ascension to the ranks of the most popular ski brands was neither swift nor smooth. At one point, sales via the normal retail channel grew so grim the U.S. distributor gave up on brick-and-mortar shops and tried to live off the growing Internet channel. The complete reversal of this catastrophic policy laid the groundwork for Stöckli’s current market momentum.

Another cornerstone of Stöckli’s present-day popularity is its top-of-the-market pricing. Once specialty shops realized that their best customers would spend more – a lot more, like $500 more – for Stöckli quality, the sales of the Swiss skis soared. In a shrinking market, the ability to charge more per transaction is the only way to preserve viability, so Stöckli evolved into the right brand at the right time. The exquisite on-snow performance of its growing collection of non-race skis validated the premium pricing and lent the brand an aura of luxury and prestige, a heady mix that also happens to drive the success of the Swiss high-end watch trade, which can’t have escaped Stöckli’s notice.

From the perspective of the insular U.S. retail market, it seems like Stöckli has assumed an unassailable position at the pinnacle of the pricing pyramid. (To give you an idea of the prices we’re talking about, the Montero AR sells for $1489 flat, $1829 with a matching binding. Race skis – still a large chunk of its collection – cost more.) But just as Rolex isn’t the only premium Swiss watch brand, Stöckli is similarly surrounded by elite competition. All the models I’ve corralled for this roundup of luxury brands teeter at the top of the market, dangling the allure of conspicuous exclusivity for the one-percenters who don’t want to be mistaken for hoi polloi.

Van Deer https://vandeer-redbull-sports.com/en

Van Deer H Power 78 ($1599)

Of all the Stöckli challengers, Austrian-made, Marcel Hirscher designed, Red Bull funded Van Deer seems best positioned to challenge the Swiss for preeminence in the ultra-exclusive genre. The construction of a new factory in Scheffau, Austria gives Van Deer a decided advantage over the field, as whoever builds the most recent, up-to-date facility can take advantage of the latest technology. The ultimate validation for any European ski maker is success on the World Cup circuit, where Van Deer athletes are already mounting podia in technical events. Availability in the U.S. is limited to a handful of specialty shops with a history of race-level service.

Stereo https://www.stereoskis.com/selectskis/

Piste Carve FC ($1400)

Norway-based Stereo is all but invisible on the American market, but it’s singing from the same hymnal as Van Deer and is a likely candidate to enter the U.S. soon. The focus is on top-quality components and eco-friendly production in their Swedish factory. Headlining the operation is Norwegian superstar Kjetil Andre Aamodt, charged with the assignment to deliver World Cup level performance. All indications are the race-bred models are first rate, but it’s questionable whether America will ever embrace high-speed carving as practiced in Europe.

Bomber https://bomberski.com/

Remember the brand Bode Miller embraced after he quit the World Cup and ended his long association with Head? It was Italian luxury brand Bomber, who continues to sell its high-end wares out of its Madison Ave. storefront. If you want to be sure fellow skiers notice that you’ve dropped over $2K on your skis, Bomber has an entire artists’ series, including the Basquiat Third Eye 78 ($2250). If you really want to make a statement, Bomber also offers a matching helmet and pole, for a look that in all probability will be all yours.

Dynamic https://dynamic.ski/en/

Dynamic VR Evolution (1150€)

For nostalgia buffs, the return of the Dynamic VR17 rekindles memories of a time when racing was the only game in town and Dynamic enjoyed a reputation as one of the great skis of its era. Actually, the 2025 VR Evolution (1150€) is a better ski, with a modern construction and superior quality control (the original was a bit iffy in this department). Well regarded in Europe, the new Dynamic has yet to dip its toes into American waters.

Volant https://www.atomic.com/en-us/shop/shared/volant.html

Volant 9000 ($3000)

Volant presents another nostalgia play, but time travel via Volant is strictly first class as the top model in the 3-model Volant family will set you back $3000. Volant began as an all-American brand (designed by Bucky Kashiwa, marketed by brother Hank), but in the current alpine ski market its natural constituency is among Europe’s carving cult. The story of Volant’s rise, fall and resurrection teaches many lessons, not the least of which is “timing is everything.” The brand’s death spiral was triggered by a bold decision to sell direct via the Internet. The retailer revolt was swift and its results fatal. How times have changed.

DPS https://www.dpsskis.com/collections/skis

DPS Pisteworks 79 ($1995)

America is home to dozens of small-batch brands that will never challenge Stöckli’s market penetration, and at least one legitimate rival for the affections of the well-heeled, Salt Lake City based DPS. There’s no better place for a brand whose first two initials stand for “Deep Powder” than the foot of the Wasatch range, and DPS will continue to focus on what it does best, but it may get its biggest boost in skier awareness by introducing the groomer-oriented Pisteworks collection, spearheaded by the apotheosis of the carved turn, Ted Ligety.

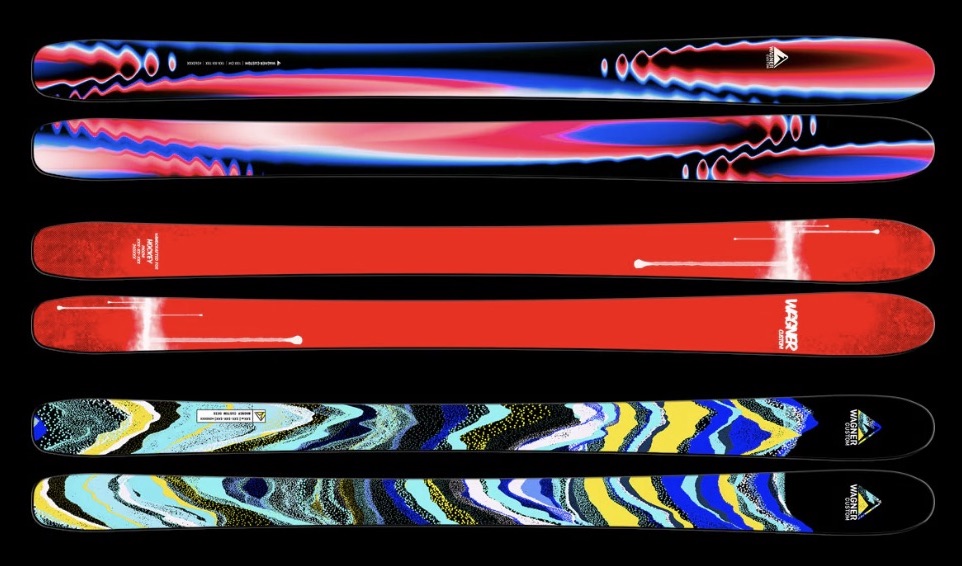

Wagner Custom Skis https://www.wagnerskis.com/pages/wagner-custom-skis

A sampling of the design options in the standard Wagner offering. ($2095)

I’m reasonably certain Pete Wagner isn’t interested in selling as many skis as Stöckli, but price-wise his bespoke designs are in the same stratospheric orbit. The basic design is all classic, quality components ($2095), with upgrades like Titanal laminates available in $400 and $800 packages. Cosmetics likewise have a stock offering and a slew of options like wood veneers and design-your-own top sheets. They may not enjoy a race pedigree like Van Deer, but Wagner customers tend to be addicted to their impeccable ride.

Epilog

This quick tour d’horizon of the luxury ski market is by no means comprehensive. I’ve left out well-regarded Blossom from Italy; exotic designs from Zai in Switzerland; eco-conscious Ferreol from Canada; custom cosmetics from Foil; killer carvers on steroids from Head-owned Indigo; Crosson, where Bode Miller had a cup of coffee between Bomber and Peak; the fashionable flair of Black Crows, the tiny Swiss Alpenstille and Canadian-made J Skis that has attracted a cadre of fanatical followers.

If that sounds like a soup-to-nuts round-up, it’s not. Not by a long shot.

I don’t know exactly how many small ski brands there are in the world, but I do know a well-respected ski industry maven who has tried to amass a comprehensive list. His current total sits at… (pause for effect)… 231. And counting.

Related Articles

The Beginning of the End

Last Thursday, I skied for the first time since recovering from lumbar fusion surgery. I use the term “recovering,” as that’s the blanket term for whatever time it takes to restore the functionality...

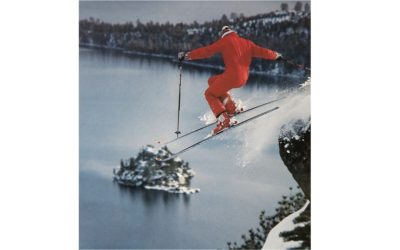

Larry Prosor belongs in the U.S. Ski & Snowboard Hall of Fame

Larry Prosor didn’t just document the birth of extreme skiing in America, he ignited it. The spark was lit by a nine-page barrage of eye-popping images lovingly displayed in the pages of Powder...

Mining the Revelations Archives

When I first raised the topic of composing a weekly newsletter with Realskiers.com founder Peter Keelty, he coughed, bit down on the Salem that was forever dangling from his lips and curtly advised...