“Nobody knows anything.”

This pithy epigram by the celebrated screenwriter William Goldman was aimed at the movie-making biz, but it is equally applicable to a ski trade trying to adapt to the exigencies of a market battered and bruised by sudden shifts in tariffs.

The on-again, off-again gyrations of the tariff rates being applied by the U.S. government – inspired by the misbegotten notion that increased tariffs would correct trade imbalances – has kept the small teams that run the subsidiaries and distributors in this country in perpetual turmoil. Any change in pricing precipitates changes in every document at every stage of a product’s odyssey from creation to delivery to the eventual customer. When preparing for several possible scenarios, the workload on an already trimmed-down staff is crushing.

The only way to avoid having to re-price one’s product line(s) was to act early and cope with the consequences. For most brands, the tariff upheaval began before all of next year’s orders had passed through customs, leaving them vulnerable to a price bump that was too great to be absorbed. There wasn’t a single brand that wanted to jack up its prices to cover the full cost of the anticipated tariff hike. Any brand that kept its prices relatively close to what was originally forecast did so by making cuts that came awfully close to the bone.

A few key factors dictated the ski supplier community’s reaction to this sudden increase in their costs. The tariff imbroglio arrived on the heels of three straight seasons of budget cuts created by sales expectations that exceeded demand. (The pandemic induced a 50% surge in sales that was naturally unsustainable.) So, when the tariff bogey appeared, there wasn’t a whole lot left in operational costs that could be trimmed. Some of the tariff surcharge would have to be passed along to dealers.

If you’re curious why all suppliers didn’t just raise their prices to cover the full impact of the tariffs, it’s because ski wholesalers have an ingrained fear of raising dealer costs, because dealers, in turn, are always afraid any price increase will scare away the inflation-scarred consumer. They’ll cut their orders before they increase retail pricing. Looked at through a dealer’s prism, the shop isn’t just buying a ski; it’s matching a price point which they know their customers will accept. The manic pressure to keep costs down is mostly driven by the fear that if prices were to continue to escalate, soon the ski trade would price itself out of business.

The ethos of keeping pricing to the dealer and concomitantly to the consumer under a tight rein is borne out by the evidence. To illustrate this point, consider the evolution of the Minimum Advertised Price for the Head Titan since the 2019/2020 season. (The MAP Price is a useful barometer as it’s the benchmark used to determine dealer margin and the most likely price the consumer will see until after the holidays.) In 2019/20, the MAP for the Titan was $999. This year, the MAP for the Titan is… $999. This price stability endured despite a couple of design modifications that raised the Titan’s performance range but didn’t raise its cost to the dealer or the consumer.

Just to drive the point home, if we peel back the veil of time to just over a decade ago, the Head Supershape i.Titan was a flagship product both within the Head collection and the Carving genre at large. The Titan’s MAP in 2014? $949. The price to the consumer, ergo the dealer, hasn’t changed meaningfully in over a decade. That same desire to avoid spooking the highly valued consumer is why subsidiaries and distributors are trying to hold prices down as much as they can, despite all the forces arrayed against them. One indication a brand can’t absorb all the tariff-induced cost increases is it will be compelled to discard the time-honored formula of separating price points by $50 increments, landing in a price-point no-man’s land.

The strained pricing system is most likely going to burst at the next opportunity, namely the preview shows next winter that bring suppliers and their customers together. Whatever elasticity in wholesale pricing that remains after this year’s bloodbath will be expended. Prices are going to go up. There may be one or two brands for whom a margin story is paramount that will seek differentiation by retaining dealer profitability at lower price points, but that tactic is likely to only be available to a couple of manufacturers.

Proponents of the notion that high tariffs will drive manufacturers to relocate to the U.S. should consider the position American-based ski brands find themselves in today. They can opt to build their skis in other countries (J Skis, Liberty), or they can import essential materials like aluminum alloy from the EU. Pete Wagner, who manufactures Wagner Custom Skis in Telluride, Colorado, points out that he can source wood, fiberglass, base and sidewall plastics in the United States, but depends on Europe for steel edges and aluminum alloy because the number of skis made in North America now doesn’t justify custom runs of specialty metals by domestic mills. “Steel and aluminum now carry a 50% tariff,” Wagner points out. “Our prices may edge up 10%.”

Regardless of the outcome of the market-share skirmish in the American ski sector, nothing will stop prices from escalating both in the season just beginning and the one peeking just over the horizon. But in neither case are the price hikes likely to seriously hurt either suppliers or retailers. For the current year, expect to see increases at retail mostly in the $20 to $50 range, and the anticipated boost in next year’s retail pricing to level off somewhere between 10% and 20%. That’s assuming tariffs on equipment originating in the EU hold at 15%, a level both sides in this trade skirmish seem ready to live with.

But will China see a similar reprieve from the threat of 25% to 35% tariff surcharges, and if not, what happens to brands that are locked into a Chinese relationship? Chinese interests already own a substantial stake in such venerable ski brands as Atomic, Salomon, K2 and Rossignol. Considering the ambitions of the Chinese ski market today, perhaps they won’t continue to be dependent on sales to their traditional consumer bases in the E.U. and U.S.A. Bear in mind, China is on pace to build out 40 ski resorts in the next 10 years. There are no obvious barriers to the impending boom in Chinese skiing.

But while China will probably end up faring just fine despite the impending 35% tariff (and additional tariffs on any aluminum or steel components), some of the markets it serves are bound to be pummeled by some combination of scarcity and price increases. In the U.S., goggle makers may be able to scramble and create some product domestically, but right now it’s hard to see how the helmet market won’t be crippled. Every ski brand is going to have to continue to spend an uncomfortable amount of its scarce human capital to stabilize its product development plans and reassure skittish markets that there’s no reason to slash orders.

What will it take for this whole, unproductive mess to resolve itself with minimum impact on today’s ski market? What it’s always required: snow. If it snows from coast to coast, $50 price increases won’t put a noticeable dent in skiing’s popularity. Throughout the history of lift-assisted skiing, skiing has been, for the most part, an elitist sport. That’s never been more true, yet it’s nonetheless still possible to ski without emptying the family treasury. For the American ski market to get healthy, we need a broad base of active skiers from Maine to California, and that won’t happen without snow.

What will be the actual impact of the recent tariff morass on the ski market this year? Sales of Epic and Ikon passes would indicate that participation isn’t about to fall off. Skiers will pay a little more for their gear, but we’re talking less than the cost of a proper ski tune. If there is snow, we will all show up to ski.

Related Articles

The Beginning of the End

Last Thursday, I skied for the first time since recovering from lumbar fusion surgery. I use the term “recovering,” as that’s the blanket term for whatever time it takes to restore the functionality...

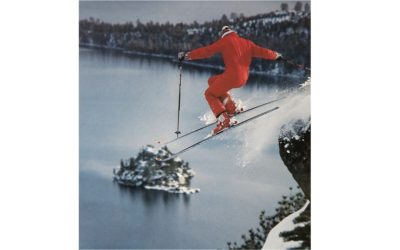

Larry Prosor belongs in the U.S. Ski & Snowboard Hall of Fame

Larry Prosor didn’t just document the birth of extreme skiing in America, he ignited it. The spark was lit by a nine-page barrage of eye-popping images lovingly displayed in the pages of Powder...

On Beyond Stöckli

Twenty-five years ago, even astute ski industry insiders wouldn’t have predicted that tiny Swiss brand Stöckli would one day be the darling of the specialty retail channel. Then as now, Stöckli’s...